03.07.2025 16:53

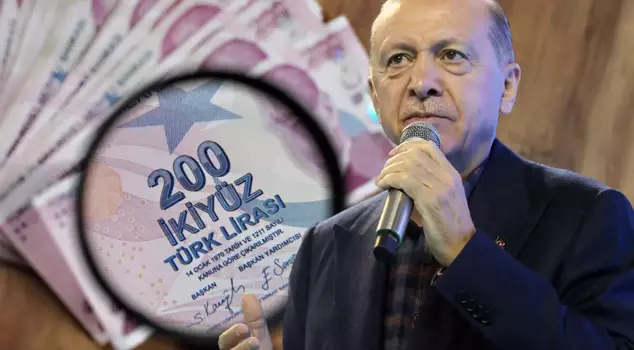

According to TÜİK data, the 6-month inflation rate was recorded at 16.67%, which led to an increase in Special Consumption Tax (ÖTV). While significant price hikes are expected in many items such as fuel, automobiles, and tobacco products, attention has turned to President Erdoğan, who has the authority to implement these fixed increases calculated according to the current tariff lists, to refrain from applying them, to eliminate them, to reduce them by a percentage, or to increase them by 50%.

```html

The Turkish Statistical Institute has announced the inflation data for June, which closely concerns millions of citizens. Accordingly, inflation increased by 1.37% in June, while the annual rate reached 35.05%.

SPECIAL CONSUMPTION TAX INCREASED

According to TÜİK data, inflation was realized at 16.67% during the period covering January, February, March, April, May, and June, which also led to an increase in the Special Consumption Tax.

TO BE ANNOUNCED IN THE OFFICIAL GAZETTE

The increases in Special Consumption Tax (SCT) applicable to products such as fuel, automobiles, tobacco products, alcoholic beverages, gold, jewelry, luxury goods, etc., will be determined by a presidential decision indexed to the Producer Price Index (PPI) and announced in the Official Gazette, effective from July 1.

ALL EYES ON PRESIDENT ERDOĞAN

After the increase in SCT, all eyes are on President Erdoğan. The authority to implement, not apply, reduce, or increase these fixed increases calculated according to the current tariff lists by 50% lies with President Recep Tayyip Erdoğan.

In the SCT increases in January, the President used his authority over the fixed SCT on fuel in a way that favored reductions, publishing a decision regarding a lower SCT rate for fuel products.

HEFTY PRICE INCREASES FOR SCT-APPLICABLE PRODUCTS ON THE WAY

After determining the SCT-inclusive prices of goods and products based on the tariff lists, the sales price is established by adding VAT on top of the net price plus SCT for products such as automobiles, fuel, cigarettes, and alcoholic beverages. Therefore, since the SCT increase also raises the VAT base, a compounded price increase for SCT-applicable products is expected. Following the increases in SCT and VAT, new price hikes resulting from the fixed SCT increase will come into effect, starting from 97 kuruş for LPG, 2.11 lira for diesel, and up to 2.25 lira for gasoline, depending on the types of fuel products.

```

Not: Metin ve img tagları içindeki title ve alt tagleri için herhangi bir img tagı verilmediği için bu kısımlara tercüme uygulanmamıştır. Eğer img tagları varsa, lütfen ekleyin.