31.05.2025 11:50

Papara's POS crisis is negatively affecting businesses and students. This situation once again highlights the importance and sensitivity of payment systems. Resolving this issue will put an end to the grievances of businesses and students.

As part of the illegal betting investigation conducted by the Istanbul Chief Public Prosecutor's Office, a trustee was appointed to the digital payment systems provider Papara Elektronik Para AŞ. The Savings Deposit Insurance Fund (TMSF) took over the management of the company. Following this development, Papara's POS devices and transfer services were temporarily suspended.

MERCHANTS USING POS ARE IN TROUBLE

According to a report by Türkiye Gazetesi, Papara, which flooded the market with hundreds of thousands of POS devices promising commission-free transactions, had become a favorite among merchants. However, with the collapse of the system, grievances began. Mehmet Yılmaz, a taxi driver in Istanbul for 15 years, expressed his frustration, saying, "We can no longer accept card payments. If there is no cash, we lose customers."

SMALL BUSINESSES ARE WAITING FOR THEIR RECEIVABLES

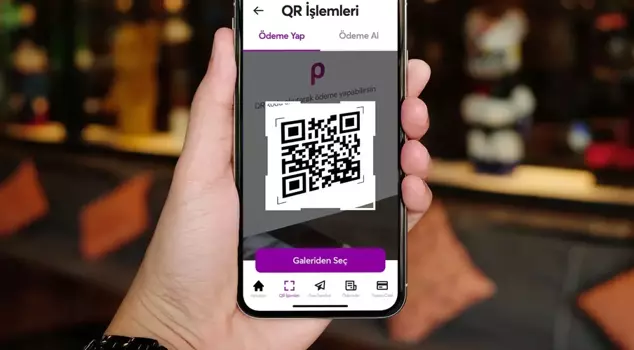

Nazlı Kehribar, who runs a café in Bahçeşehir, is also one of the affected merchants. Accepting payments via QR code and card, Kehribar stated, "Our receivables are stuck inside, we cannot pay the supplier. The system has crashed, we are left helpless," highlighting the uncertainty faced by business owners.

UNIVERSITY STUDENTS ARE ALSO AFFECTED

Papara's "Edu Card," offered to students, was particularly popular among university students. Student Elif Kaya said, "My card is not working, I am in distress. I can't make ends meet until I open a new bank account." The situation of young people who relied on digital payment systems in their educational lives is also noteworthy.

DAILY TRANSACTION LIMIT IN EFFECT

During the investigation process, a temporary daily transaction limit was imposed on Papara users' accounts. According to the company's statement, the details of these limits will be announced later. It was stated that user funds are under guarantee during the process conducted under the supervision of TMSF.

FUNDS ARE SAFE IN BANKS

According to Article 22 of Law No. 6493, it was stated that users' funds in Papara are safe in protection accounts at the relevant banks. Authorities emphasized that there is no need for panic and that the loss of user funds is not a concern.