19.12.2024 10:41

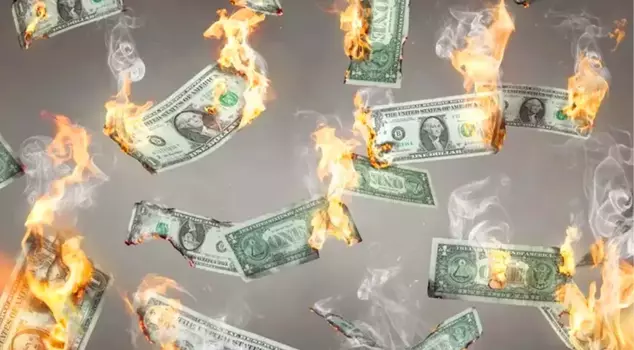

The Federal Reserve's (FED) interest rate decision created a significant shock in the cryptocurrency world. Following this, millions of dollars seemingly vanished within minutes due to statements from the Bank.

```html

After the Federal Reserve's (FED) interest rate decision, sharp declines were experienced in the cryptocurrency markets. Bitcoin fell to the level of 101 thousand dollars with a loss of over 5%, while a total of 806 million dollars evaporated in the futures markets.

FED CUTS INTEREST RATE BY 25 BASIS POINTS

The FED lowered the policy interest rate by 25 basis points to a range of 4.25-4.5%, in line with market expectations. FED Chairman Jerome Powell stated that further reductions in borrowing costs would depend on the decline in inflation.

Powell said, "I think we are in a good place, but from here on, it is a new phase, and we will be cautious about the continuation of reductions."

SHARP DECLINE IN CRYPTO MARKETS

Following Powell's statements, sales in risky assets accelerated. Bitcoin, which tested above 108 thousand dollars during the week, fell over 5% to around 101 thousand dollars.

Ethereum also lost 8%, dropping from 4 thousand dollars to 3 thousand 670 dollars. XRP, one of the biggest winners of the Trump rally, fell over 10% to 2.35 dollars.

POWELL'S DISTANT APPROACH TO BITCOIN RESERVE

In response to a question about the Bitcoin reserve, FED Chairman Powell said, "The FED is not allowed to own Bitcoin." He stated that the issue of Bitcoin reserves should be discussed by Congress, adding, "The FED does not want a change in the law."

These statements contradict the plans of U.S. President Donald Trump to create a strategic Bitcoin reserve. The new president of the U.S., Donald Trump, had announced that he would establish a strategic Bitcoin reserve.

806 MILLION DOLLARS WIPED OUT

The sharp decline in cryptocurrencies led to significant losses in the futures markets. In the last 24 hours, 278 thousand investors had to close positions worth a total of 806 million dollars.

Of these positions, 685 million dollars were long positions, while 121 million dollars were short positions. The volatility in the cryptocurrency markets continues to be closely monitored.

```