18.02.2025 10:01

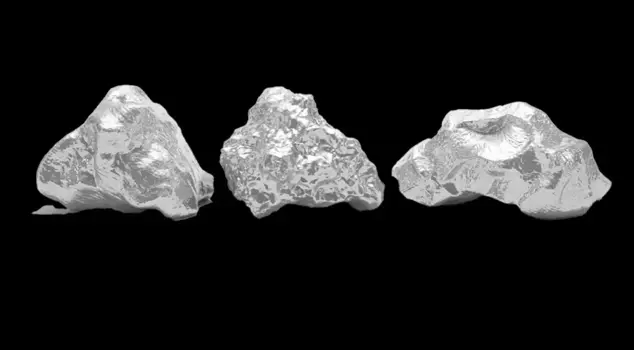

While investors are focused on gold prices, the rapid rise in silver prices is drawing attention. According to the latest data, silver prices are approaching a 10-year high. The price of silver per ounce has reached $33.41 for the first time.

Records are being broken one after another in precious metals. While the records seen in gold are attracting global attention, silver, which has more price volatility compared to gold, has also started to challenge its historical record. The price of the gray metal briefly exceeded $33 at the end of last week, reaching its highest level since October 2024.

INCREASE OF 12% IN ONE AND A HALF MONTH

Closing the day at $33.41 per ounce, the increase recorded since the beginning of the year has reached 12%. Prices had seen a 10-year peak of $34.87 per ounce on October 22. Some analysts say that investors in the metal are aiming to challenge the 10-year peak just below $35 per ounce again.

RENEWABLE ENERGY DEMAND INCREASES SILVER'S APPEAL

The increase in demand for electrification and manufacturing has triggered silver purchases. Following the U.S., China's shift towards producing 357 gigawatts of solar and wind energy in 2024 is among the reasons pushing silver prices higher. Additionally, India's Oil and Natural Gas Company has committed to investing 1 trillion rupees in wind and solar energy by the end of the decade, and Indonesia has also promised to add 17 gigawatts of solar energy, further increasing demand for silver.

CRITICAL WARNING FROM EXPERTS

According to market makers, if the current momentum continues, silver could challenge the $35 level. However, experts warn that high price volatility could lead to increased downside volatility in silver, and therefore caution is advised.

Note: The content in this news article is not investment advice.