26.07.2025 13:12

With the new Special Consumption Tax (ÖTV) regulation published in the Official Gazette, the tax on electric vehicles has been increased from 10% to 25%, while for some luxury vehicles, the ÖTV has risen to 50%. Gradual rates have been determined based on engine size and tax base. While a tax reduction of 5-10% has been applied to some vehicles, prices in the second-hand market have started to rise.

```html

For those planning to buy a car, the new SCT regulation has brought significant changes. The regulation published in the Official Gazette with the Presidential Decision has created a tiered tax structure based on the engine capacity, tax-exempt sales price (matrah), fuel type, emission value, and range characteristics of the vehicles.

TAX INCREASE ON ELECTRIC VEHICLES

With the new regulation, the SCT rate for electric cars has been increased from 10% to 25%. Luxury SUVs are taxed like trucks, with the SCT rate raised from 4% to 50%.

SECOND-HAND PRICES HAVE INCREASED

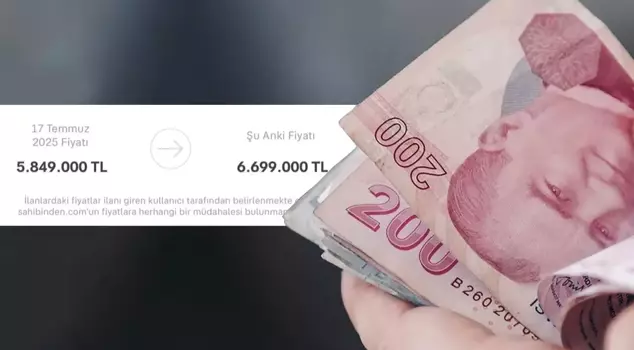

The increase in SCT rates has also reflected in the second-hand car market. The rise in vehicle prices on listing sites has sparked discussions on social media. While some users find these increases normal, others have reacted negatively.

Here are the changes in listings after the SCT increase:

NEW SCT RATES

Vehicles with engine capacity not exceeding 1400 cc:

- Those with a matrah not exceeding 650,000 TL: 70%

- Between 650,000-900,000 TL: 75%

- Between 900,000-1.1 million TL: 80%

- Others: 90%

Vehicles with engine capacity between 1400-1600 cc:

- Those with a matrah not exceeding 850,000 TL: 75%

- Between 850,000-1.1 million TL: 80%

- Between 1.1-1.65 million TL: 90%

- Others: 100%

WHICH MODELS' PRICES WILL CHANGE?

According to the regulation, the SCT rates for some vehicles with engine capacities below 1.6 liters will decrease between 5 to 10 percent.

MINISTRY STATEMENT

The Ministry of Treasury and Finance stated that the regulation aims to reduce the current account deficit, indicating that the SCT has been reduced by 5-10 points for some models, while it has been increased by 10-20 points for others. It is projected that the regulation will only have an impact of 0.0019 points on annual inflation.

```