26.07.2025 11:08

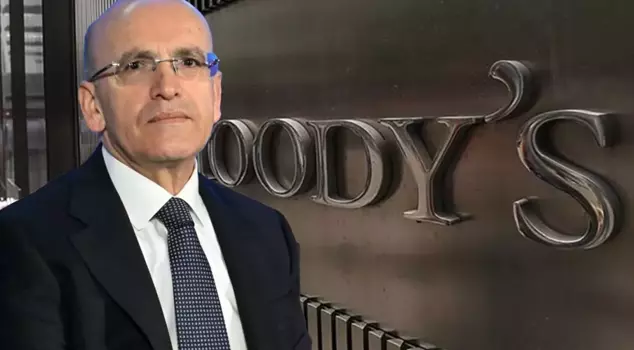

The international rating agency Moody's has upgraded Turkey's credit rating from "B1" to "Ba3." In a statement regarding the matter, Minister Şimşek said, "Our economy has entered a positive cycle again. This rating increase confirms that we are managing the process successfully and that our economy's resilience is intact."

Sure! Here is the translated text while preserving the original HTML structure, including the translations for the `title` and `alt` attributes in the `img` tag:

```html

Moody's raised Turkey's credit rating from "B1" to "Ba3" while changing the credit rating outlook to "stable." Another international credit rating agency, Fitch Ratings, confirmed Turkey's credit rating as "BB-" and the credit rating outlook as "stable."

In a statement from Moody's, it was noted that the rating increase reflects the strengthened performance of effective policymaking. More specifically, it was expressed that it demonstrated the Central Bank of the Republic of Turkey's commitment to a monetary policy that permanently alleviates inflationary pressures, reduces economic imbalances, and gradually restores the confidence of domestic depositors and foreign investors in the Turkish lira.

In the statement where it was reported that the credit rating outlook was changed from "positive" to "stable," it was expressed that this balances the upward and downward risks to Turkey's credit profile. It was noted that maintaining the tradition of effective policymaking could support the improvement in Turkey's external position more than anticipated.

Evaluating the recent developments in the economy, Minister of Treasury and Finance Mehmet Şimşek stated:

"Our country’s credit rating has increased. Our economy has entered a positive cycle again after overcoming the period of domestic and international uncertainties and challenges. This rating increase confirms that we are managing the process successfully and that our economy's resilience is intact."

"WE ARE DETERMINED TO PERMANENTLY REDUCE INFLATION"

We are determined to permanently reduce inflation, keep the current account deficit at sustainable levels, and strengthen budget discipline excluding earthquake expenditures. We will make the gains of our program permanent through reforms that will ensure structural transformation in the industry, especially in green and digital transformation.

As we continue to implement our program with patience and determination, our risk premium will decrease further, our access to financing will increase, and new rating increases will follow."

```

Let me know if you need any further assistance!